Against the backdrop of a global decline in wine consumption in 2020, the volume of still wine consumed in Brazil grew by +28%, boosted by an expanding wine-drinker base and more adventurous consumers

Although global wine consumption declined in 2020, wine broadly pivoted well to the at-home occasion as regular wine drinkers in markets such as the UK, Australia, Brazil, Canada and the US increased their frequency of wine consumption.

In Brazil, volumes of still wine grew by +28% last year, and the category is forecast to continue to grow over the next 5 years, albeit at a more modest rate, according to IWSR data.

This growth in Brazil’s wine market was driven by a number of factors, including structural long-term drivers as well as evolving consumer behaviour and attitudes. Wine volumes overall have been growing due to a rise in higher-quality imports and increasingly accessible prices. And although wine is still an emerging category, with per capita consumption remaining low, awareness and interest in wine is gaining momentum among Brazilians.

The key consumer behaviours underpinning wine’s growth in Brazil are:

- Expanding wine-drinker base

Wine Intelligence data reveals that the base of wine consumers in Brazil is growing. In 2010, approximately 20m adults of legal drinking age (LDA) were regular wine drinkers – defined as those who drink wine at least once a month. By 2020, this number had risen to close to 40m.

- Digitally connected consumers

Brazilians have been quick to adopt digital platforms. The popularity of ecommerce for wine purchasing was high in Brazil before the pandemic, with more than one-quarter of consumers using online channels to purchase wine. While the impact of Covid-19 boosted alcohol ecommerce in 2020, the channel is expected to continue to grow in the future as well.

- Low on-trade exposure

Proportionally, more wine is sold via the off-premise in Brazil than in the on-premise: pre-Covid-19, only around 20% of wine was consumed in the on-premise, according to IWSR. The historic reliance on off-premise channels meant that Brazilians did not have to make big changes to their wine-purchasing habits during the pandemic lockdowns.

“There is also considerable sophistication in the supply and promotion of wines in supermarkets across the country, particularly in regional retail networks,” comments Rodrigo Lanari, LatAm Territory Manager at Wine Intelligence. “Without being able to frequent restaurants, consumers still had access to their preferred brands of a wide variety of styles, origins and price points.”

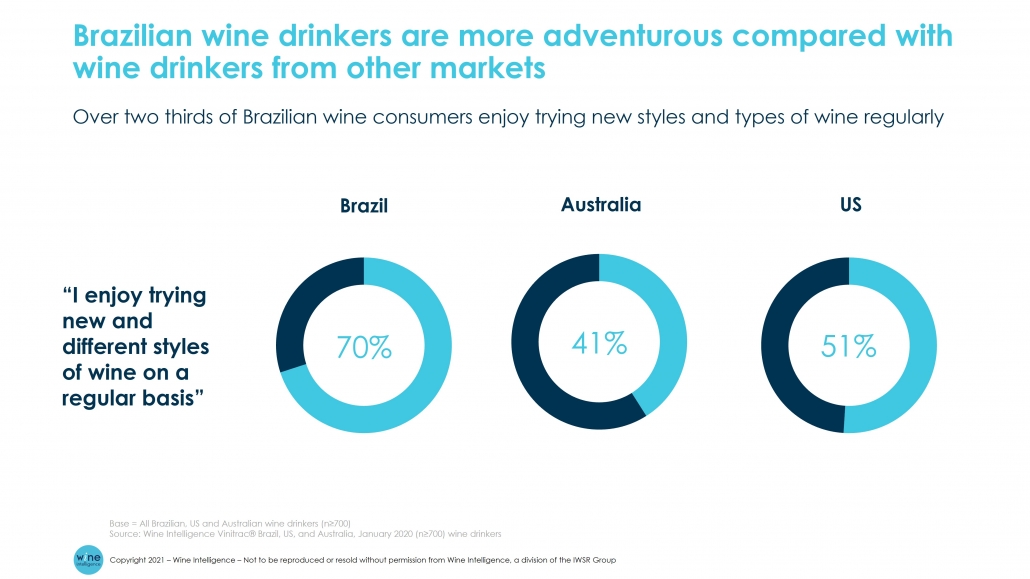

- Brazilian consumers strongly motivated by trial of new wines

A key characteristic of Brazilian wine drinkers is their openness to trying new styles and types of wine: 70% of wine drinkers state that they ‘like trying news types and styles of wine’ – compare this to 51% of wine consumers in the US, 47% in China and 43% in the UK. In addition, the percentage of Brazilian consumers classified as highly involved with wine rose from 26% in 2017 to 30% in 2020. These underlying consumer preferences helped to usher wine into new consumption occasions when choices for leisure and entertainment were limited.

- Expanding at-home occasions for wine

Wine consumption at home during the pandemic was not limited to meal and formal occasions. In August and September 2020, for example, non-food wine occasions increased in frequency, with drinkers citing that they enjoyed wine as “a relaxing drink at the end of the day at home” more often than they did pre-pandemic.

“Looking ahead, digitally savvy and adventurous consumers offer a growing opportunity for the Brazilian wine market,” concludes Lanari.

You may also be interested in reading:

Leave a Reply

Want to join the discussion?Feel free to contribute!